Product-market fit is that magical moment when you realize you're not pushing your product on people anymore. Instead, the market is actively pulling it from you. It's the point where you've built a solution for a real, painful problem, and customers are not only willing to pay for it but are genuinely excited to do so. This is when your startup stops feeling like a gamble and starts looking like a predictable, scalable business.

Why Product-Market Fit Is Your Startup's Lifeline

Let's cut to the chase: if you ignore the hunt for product-market fit, you're on the fastest track to burning through your cash and joining the startup graveyard. This isn't just another buzzword to throw around in pitch meetings; it's the absolute bedrock of a successful company. It’s the proof that you’ve built something a specific group of people genuinely needs and will happily pay for.

The brutal truth is that most startups don’t fail because of bad code or a lack of funding. They fail because they build something nobody actually wants.

"Product/market fit means being in a good market with a product that can satisfy that market." - Marc Andreessen

This quote from Marc Andreessen nails it. The market always wins. You can have the most brilliant engineers and a killer marketing team, but if your product doesn’t solve a real-world, pressing problem for a specific audience, you're just pushing a boulder uphill.

The Danger of Mistaking Early Buzz for Real Demand

One of the most common traps I see founders fall into is confusing a few early sign-ups for true product-market fit. A bit of initial traction or some nice comments from friends and family can create a dangerous false sense of security. This often leads to the fatal mistake of scaling way too soon.

That’s when things get very, very expensive. Pouring money into marketing a product that doesn't have a natural pull is like trying to fill a leaky bucket—your resources just drain away.

This misstep can be devastating and often irreversible:

- Wasted Capital: Huge marketing and sales budgets get torched trying to convince people they have a problem, instead of serving a need they already feel.

- Team Burnout: The constant, grinding struggle to gain traction without any organic momentum is a surefire way to kill morale and exhaust your team.

- Damaged Reputation: Launching a solution that completely misses the mark can poison the well, making it much harder to pivot and re-engage that market later.

The numbers are clear. The top reason startups fail is a lack of market need, with a staggering 42% of failed startups pointing to this as the cause. Of those, 34% blame their failure directly on not finding product-market fit. That statistic alone should tell you everything you need to know.

This guide is your roadmap, taking you from those first hunches to knowing with confidence that you’ve finally found it. To get a comprehensive view of the entire process, check out this excellent guide on How to Find Product Market Fit.

Defining Your Customer and Value Hypothesis

Before you even think about writing a line of code or putting a single dollar into ads, you have to nail two things: Who are you building for? and Why should they care? Seriously. This is the bedrock of your entire product-market fit journey. Skipping this step is like trying to build a house on quicksand—it’s going to end badly.

Too many teams get this wrong. They sketch out these generic, lifeless personas like "Marketing Mary" who just "wants to increase ROI." That’s not a target; it’s a vague wish. You need to find a specific, underserved group of people whose problems you can genuinely solve.

Don't target "accountants." Instead, get granular. Target "freelance accountants who specialize in e-commerce clients and waste 10 hours a month manually reconciling Shopify payouts." See the difference? That’s a real person with a real, quantifiable problem. That’s a target you can actually hit.

Pinpointing the Underserved Customer

Your job is to find that hyper-specific niche and become an expert on their world. You need to understand their daily workflow, their biggest headaches, and the clumsy "hacks" they've cobbled together to get by. Your ideal customer isn't just someone with a problem; they're someone who feels the pain of that problem right now.

To sharpen your focus, ask yourself these kinds of questions:

- What job are they really trying to do? Forget their job title. What is the actual outcome they're responsible for?

- What’s stopping them? Pinpoint the exact bottlenecks, slowdowns, or frustrations that make their job harder than it should be.

- What happens when things go wrong? Does it cost them time? Money? Their reputation? The higher the cost, the more they need what you're building.

- What’s their current workaround? Are they wrestling with a monster spreadsheet? Juggling three different tools that don't talk to each other? Your real competition is often just a messy manual process.

This customer discovery work is non-negotiable. If you're having trouble even finding these people to talk to, you'll need to get good at learning how to find clients online, not just for sales, but for this critical early research.

Crafting Your Value Hypothesis

Once you have a razor-sharp picture of your customer and their deep-seated pain, you can build your value hypothesis. This isn't some fluffy marketing slogan. It's a clear, testable statement that draws a straight line from their problem to your solution.

A solid value hypothesis has three key ingredients: the customer, their problem, and your unique fix.

Here’s a simple framework to follow:

"We believe that [specific customer segment] struggles with [painful problem] because of [root cause], and we can help them achieve [desired outcome] with [your unique solution]."

Let’s go back to our freelance accountant. A value hypothesis that actually means something would sound like this:

"We believe that freelance e-commerce accountants waste a ton of billable hours on manual Shopify reconciliation because existing software isn't built for it. We can help them save 10+ hours per month with an automated tool that syncs payouts, fees, and taxes in one click."

This is powerful because it isn’t just an idea—it’s a series of assumptions you can go out and test. You can validate (or invalidate) every single piece of that statement with real-world experiments. It gives your team a North Star, guiding what you build for your MVP and what you test first.

This kind of clarity stops you from chasing shiny objects and building features nobody asked for. It focuses your entire team on solving the one problem that actually matters to your target market. With this foundation in place, you’re ready to move from theory to reality and start gathering some data.

Alright, you’ve nailed down your core hypotheses about who your customer is and what they need. Now comes the fun part: putting those assumptions to the test with real people. This is where the rubber meets the road, moving from theory to tangible feedback.

We’re not talking about sinking months into building a full-blown product. Instead, we'll use a handful of quick, low-cost experiments designed to get you critical answers, fast. It’s all about validation—proving or disproving your ideas with actual market data, not just what sounded good in a meeting.

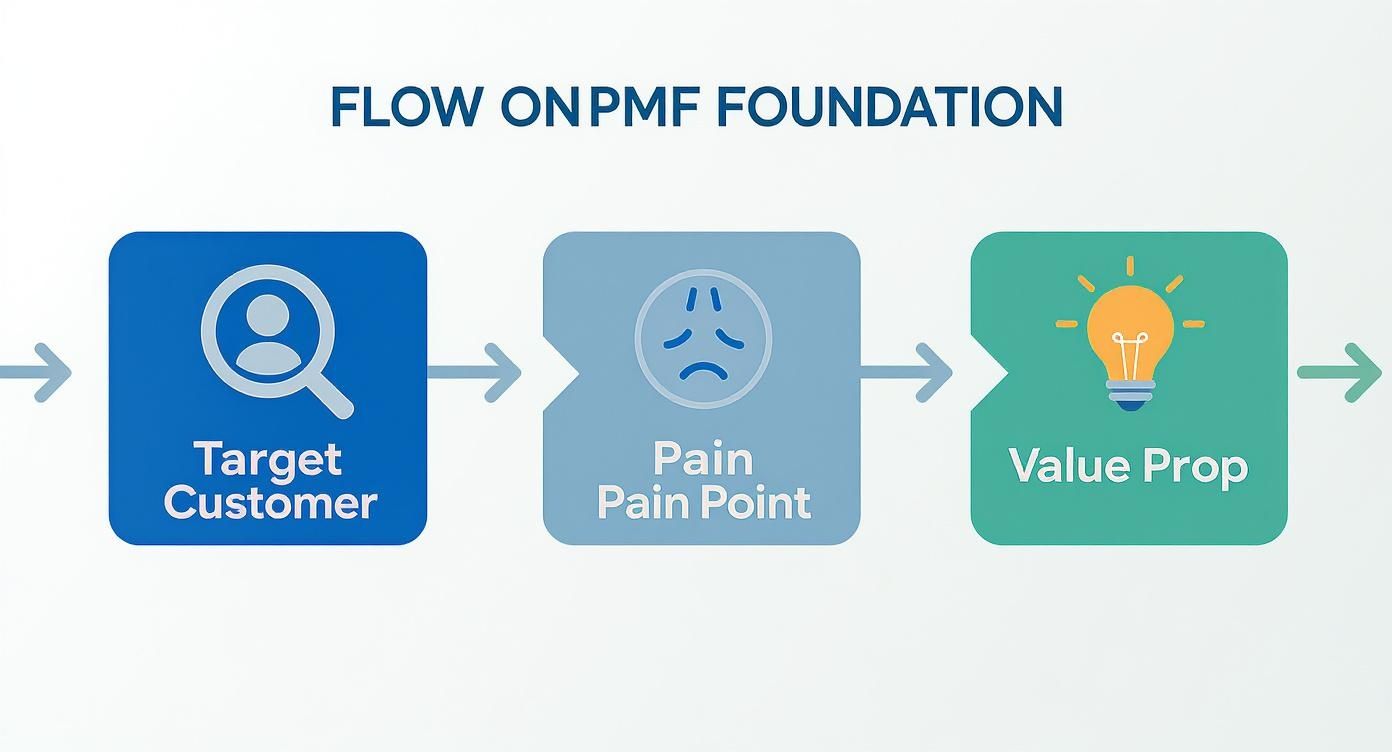

The flow you've established—pinpointing a target customer, their core pain, and your value prop—is solid. But each part of that flow is still just an assumption.

Let's look at how to test these assumptions without breaking the bank.

Validating Demand with a Simple Landing Page

One of the fastest and cheapest ways to see if anyone actually cares about your idea is a "smoke test" landing page. Think of it as a movie trailer for your product. It’s a single webpage describing your solution as if it already exists, complete with a killer headline, clear benefits, and one single call-to-action (CTA).

The goal isn't to make a sale; it's to sell the idea. The CTA is usually a low-friction ask, like "Join the Waitlist" or "Request Early Access," linked to an email signup form. The number of people who sign up is a direct measure of interest.

For this to work, the page has to be laser-focused:

- Headline: Hit the pain point you identified, head-on.

- Body: Explain exactly how you solve that pain. Use bullets for the top three benefits.

- CTA: Make it an obvious, easy next step for the visitor.

The key metric here is the conversion rate. If you can get a 5-10% conversion rate from targeted traffic, you've got a strong signal that you’re onto something real.

Gauging Audience Interest with Small Ad Campaigns

Once the landing page is up, you need to get the right eyeballs on it. Small-scale paid ad campaigns on platforms like LinkedIn, X (formerly Twitter), or Google are perfect for this. You don’t need a huge budget; even $100-$200 can give you enough data to start making informed decisions.

The real magic here is that you can test multiple assumptions at once.

By running different ad variations, you can A/B test your messaging, your audience targeting, and even different angles on your value prop. Your click-through rate (CTR) and cost per signup will tell you exactly which combination is hitting a nerve.

For instance, let's say you're targeting B2B marketers. You could run one ad promising to "cut reporting time in half" and another focused on "proving campaign ROI." The ad that gets more clicks and cheaper signups is a massive clue about which problem is more urgent for your audience. It's a real-world vote from your market, paid for with their attention.

Uncovering the Truth with Customer Interviews

While landing pages and ads tell you what people do, qualitative interviews uncover the why. This is your chance to hear raw, unfiltered feedback directly from potential customers. The trick is to ask questions that reveal their world, not just validate your own ideas.

Ditch leading questions like, "Wouldn't a tool that does X be amazing?" People are polite; they'll probably just agree with you.

Instead, dig into their past behavior and current headaches. Try questions like these:

- “Tell me about the last time you had to deal with [the problem].” This prompts a story, revealing their real process, tools, and frustrations.

- “What have you already tried to solve this? What did you like or dislike about those options?” This uncovers their current workarounds and shows you who you’re really competing against (often, it's just a spreadsheet).

- “If you could wave a magic wand and fix one thing about this process, what would it be?” This lets them describe their dream solution, which might be completely different from what you were planning to build.

Listen closely to the specific words and phrases they use to describe their problems. This is gold for your future marketing copy. You can even find people who are already talking about these pains online by using a good social listening tool, which can point you directly to perfect candidates for these interviews.

Defining Success for Each Experiment

Before you launch a single test, you need to know what a "win" looks like. Without clear success criteria, it's far too easy to see what you want to see in the results.

Set up a simple framework for each experiment you run.

| Experiment Type | Primary Goal | Key Metric | Success Criteria Example |

|---|---|---|---|

| Landing Page | Validate problem/solution resonance | Email Signup Conversion Rate | Achieve a >5% conversion rate from targeted traffic. |

| Paid Ad Test | Identify the most compelling value prop | Click-Through Rate (CTR) | Message A achieves a 50% higher CTR than Message B. |

| Customer Interview | Uncover deep customer pain points | Problem Validation | 8 out of 10 interviewees rank the problem as a top 3 priority. |

This kind of structured approach takes the emotion and guesswork out of the equation. The data you gather will be your guide, telling you whether to iterate, pivot, or hit the accelerator.

Decoding the Signals of Product Market Fit

So, you’ve run your experiments and the data is rolling in. Now comes the big question: do you actually have product-market fit? Let’s be clear—it’s rarely a single, lightning-bolt moment. It’s more like a collection of strong, consistent signals telling you that you’ve finally struck a nerve.

Finding PMF is less about one metric hitting a magic number and more about feeling a fundamental shift in momentum. The exhausting, uphill battle to find and keep customers starts to get easier. Instead of you pushing your product onto the market, the market starts pulling it from you. You'll see this shift in both your quantitative data and your qualitative feedback.

The Sean Ellis Test: The Gold Standard Metric

Perhaps the most direct way to measure PMF comes from the brutally simple and effective Sean Ellis Test. It boils down to asking your users one critical question:

"How would you feel if you could no longer use this product?"

They can choose from three answers:

- Very disappointed

- Somewhat disappointed

- Not disappointed

The benchmark you're looking for is what’s often called the “40% rule,” a concept pioneered by Sean Ellis himself. If at least 40% of your users say they’d be “very disappointed,” you’re likely on to something big. For example, Slack knew it had hit a home run when around 51% of its users chose that top answer. You can dig deeper into how other founders use this metric to gauge their success.

This single question cuts right through the vanity metrics. It’s not about satisfaction; it’s about dependency. If you're falling short of that 40% threshold, it’s a clear sign your product is still a "nice-to-have" for too many people, not the "must-have" you're aiming for.

Beyond a Single Score: Key Qualitative Indicators

While the 40% rule is a fantastic benchmark, numbers never tell the full story. You have to pair that hard data with the softer, qualitative signals to get a complete picture. Honestly, real product-market fit just feels different.

You’ll start to see it in how people talk about and interact with your product.

- Organic Word-of-Mouth: Are people recommending you without being asked? When you see new customers coming from places you don't control, like a private Slack community or a conversation in a conference hallway, that's a huge win.

- Users Panic When It’s Down: Your server has a hiccup for five minutes and your support channels are instantly flooded with worried users. This is a great problem to have. It means they truly rely on you.

- Effortless Press and Reviews: You stop chasing journalists. Instead, they start reaching out to you because they’re hearing buzz from their own networks.

When you have product-market fit, you can feel the momentum. Your customers become your best salespeople, your retention rates stabilize, and the path to scaling becomes clear. If you have to ask if you have it, you probably don’t.

This organic pull is the clearest sign you can get. It shows your product has become an essential part of your customers' lives or workflows.

Building Your PMF Dashboard

To keep track of everything without getting overwhelmed, you need a dedicated Product-Market Fit Dashboard. This isn't the same as your main business KPI dashboard. It's a focused, no-fluff view of the leading indicators that tell you if you’re resonating. Review it weekly.

A good PMF dashboard connects user sentiment (what they say) with user behavior (what they do). The metrics below give you a powerful, multi-faceted view of your progress.

Core Product-Market Fit Metrics and Their Thresholds

| Metric | What It Measures | Strong PMF Signal |

|---|---|---|

| Sean Ellis Score | User dependency on your product. | >40% "Very Disappointed" |

| Net Promoter Score (NPS) | User willingness to recommend. | >50 (for B2B SaaS) |

| User Retention Rate | The percentage of users who stick around over time. | A flattening retention curve after 2-3 months. |

| Activation Rate | The percentage of new users who complete a key action. | Consistently high and stable percentage. |

| Organic vs. Paid Growth | The ratio of new users from organic channels. | Organic acquisition consistently outpaces paid. |

Analyzing these metrics together tells a much richer story. A high Net Promoter Score is great, but if your retention is terrible, it might mean users love the idea of your product but aren’t getting real value. On the flip side, strong retention with a low Sean Ellis score could mean your product is sticky but not indispensable, leaving you vulnerable to a competitor who builds something better.

By constantly monitoring these signals, you replace guesswork with a data-informed process. This dashboard becomes your compass, guiding your decisions on whether you need to keep iterating or if it’s finally time to hit the accelerator and scale.

Making the Call: When to Iterate, Pivot, or Scale

Collecting data from your experiments is one thing. Knowing what to do with it is where the real magic happens. This is the moment that can define a startup’s entire trajectory. You’re standing at a fork in the road, metrics in hand, and you have to decide: do you tweak the engine, change direction, or floor it?

Let’s be honest—this decision is never as clean as the textbooks make it sound. The data is often a messy, contradictory puzzle.

What do you do when your Net Promoter Score (NPS) is through the roof, but your Sean Ellis score is stuck below that critical 40% threshold? Or when users are logging in every day, but your retention curve nosedives after month one? These mixed signals aren't a sign of failure; they're normal. The trick is having a framework to read the tea leaves correctly instead of just going with your gut.

How to Read the Mixed Signals

When the data feels contradictory, the first rule is: don't panic. The second is to start segmenting. A single, blended metric often hides the real story. The truth usually emerges when you isolate the feedback from your most engaged, high-value users—the people who actually fit your ideal customer profile.

For instance, a low overall Sean Ellis score might be getting dragged down by a bunch of tire-kickers who were never the right fit anyway. What happens if you re-run that number using only the responses from your power users? If that segment is well over the 40% "very disappointed" mark, you don’t have a product problem. You have a targeting and messaging problem.

Here’s how to untangle some common, confusing patterns:

- High Engagement, Low Retention: This is a classic. It means users are excited by the promise of your product but aren't finding lasting value. Maybe your onboarding is confusing, or the core workflow has too much friction. It’s time to iterate on the user experience.

- High NPS, Low Sean Ellis Score: This one is subtle. It suggests people like your product, but they don't need it. It’s a “nice-to-have.” Your job is to iterate on the features that can make your solution indispensable to their daily work.

- Strong Retention, Low Growth: You've built something incredibly sticky for a tiny group of people. Fantastic! You've found a real need in a niche. Now you need to iterate on your go-to-market strategy to figure out how to find more of these people.

The Iterate vs. Pivot Framework

Once you’ve got a better handle on the real problem, you can decide what to do about it. The choice isn't just a simple "it works" or "it doesn't."

Finding product-market fit isn't a single event you check off a list. It’s a continuous loop of listening to the right people, learning from them, and refining your approach.

This is why tools like the "disappointment index" test are so valuable. Startups like Dropbox and Superhuman famously used it to quantify what was once just a feeling. Early on, Superhuman found that only 22% of users would be "very disappointed" if the product vanished—a clear signal of weak PMF. Instead of giving up, they dug into the feedback from that 22% and iterated relentlessly. They eventually drove that number up to an incredible 58%, proving they’d finally nailed it. You can see how other data-obsessed startups tackle this on Penfriend.ai.

- Iterate: If you're seeing strong positive signals from a specific user segment, that's your cue to double down. An iteration isn’t a complete overhaul; it’s a focused improvement. You might refine a core feature they love, smooth out an onboarding step they stumble on, or tweak your pricing based on their feedback. You’re amplifying what already works for the right people.

- Pivot: A pivot is for when your core assumptions are proven wrong again and again, across every segment you test. Don't think of it as failure. It's an expensive, but incredibly valuable, lesson that lets you make a much smarter bet next time. This might mean targeting a completely different customer or even solving a different problem you discovered along the way.

Knowing When It's Time to Hit the Accelerator

You’ll know it’s time to scale when the dynamic shifts. The frantic push for customers starts to feel more like a powerful pull from the market.

Your key product-market fit metrics are not just strong, but stable. Organic sign-ups are outpacing your paid efforts. And when you do spend on marketing, it just works better. This is when you need to get smart about your spend and really understand how to calculate marketing ROI to make sure every dollar is pushing you forward.

After you've iterated, validated, and confirmed you have a solid foundation, you can explore proven SaaS growth strategies to take things to the next level. This is the moment you’ve been working for—when you can confidently pour fuel on the fire, knowing it's ready to roar.

Navigating the Gray Areas: Your Product-Market Fit FAQs

Even with a roadmap in hand, the path to product-market fit is rarely a straight line. It's full of twists, turns, and tough calls. Let's dig into some of the most common questions that come up when you’re deep in the trenches.

How Long Should This Process Take?

This is the classic "how long is a piece of string?" question, and honestly, anyone who gives you a hard number is guessing. There's no magic timeline. Some teams luck into it in a few months, while for others, it’s a multi-year slog of testing, learning, and rebuilding.

What really matters here isn’t speed, but momentum. Are you consistently running experiments? Are you learning something new every week? If your metrics are inching in the right direction and your understanding of the customer is getting sharper, you’re on the right track. Focus on maintaining a tight cycle of hypothesizing, testing, and learning—the timeline will take care of itself.

What If I Get Conflicting Customer Feedback?

Conflicting feedback isn't just common; it's a guarantee. You'll have one user begging for a feature that another user swears would be useless clutter. This is precisely why your Ideal Customer Profile (ICP) is your north star.

When feedback pulls you in different directions, run it through your ICP filter.

- Segment your feedback. Is this comment coming from someone who perfectly fits your ICP, or from a tire-kicker who will never be a great customer? Their opinions don't carry equal weight.

- Prioritize core pain points. Does the feedback relate directly to the big, hairy problem you set out to solve for your target market? Or is it a nice-to-have tangent?

- Hunt for patterns, not one-offs. A single request is an anecdote. Ten requests for the same thing from ten different ICP-fit customers? That's a signal you can't ignore.

Don't fall into the trap of trying to please everyone. You’ll end up with a watered-down product that nobody truly loves.

Your goal isn’t to average out all the feedback into a mediocre compromise. It's to find the sharpest insights from the people who matter most and build a solution that feels like it was made just for them.

Can You Lose Product Market Fit After Finding It?

Absolutely. And it happens more often than you think. Product-market fit is not a one-and-done achievement you can frame on the wall. It's a living, breathing thing that needs constant attention.

Markets shift. Customer needs change. New competitors pop up. Technology evolves. Blockbuster and MySpace are the poster children for this—they had an iron grip on their markets and then lost it all by failing to adapt.

Staying ahead means the discovery process never really stops.

- Keep talking to your customers. The feedback channels you built to find PMF should stay open forever.

- Watch the market like a hawk. Keep an eye on new trends, competitive moves, and shifts in your customers' worlds.

- Never stop iterating. Your product has to evolve in lockstep with your customers.

Treating product-market fit as a finish line is one of the most dangerous mistakes a founder can make. It's a continuous loop of listening, learning, and adapting to make sure you remain the best solution.

Finding your audience is just the beginning. Keeping them engaged with authentic, helpful dialogue is how you build a brand that lasts. Replymer turns online conversations into a powerful growth channel by having real writers recommend your product in the right discussions on Reddit, X, and LinkedIn. See how Replymer can drive organic demand for you.